No longer on display. Expired on

10 November 2022, 11:59 PM

Notice is hereby given that Monash City Council resolved on 27 September 2022 to give public notice of its intention to declare a Mount Waverley Activity Centre Special Charge (“Proposed Scheme”) pursuant to section 163 of the Local Government Act 1989 (the “Act”).

The Proposed Scheme will be declared for the purpose of defraying the expenses of advertising, promotion, Centre management, business development and other incidental expenses associated with the encouragement of commerce at the Centre.

It will commence on 1 December 2022 and remain in force for a period of five years, ending 30 November 2027.

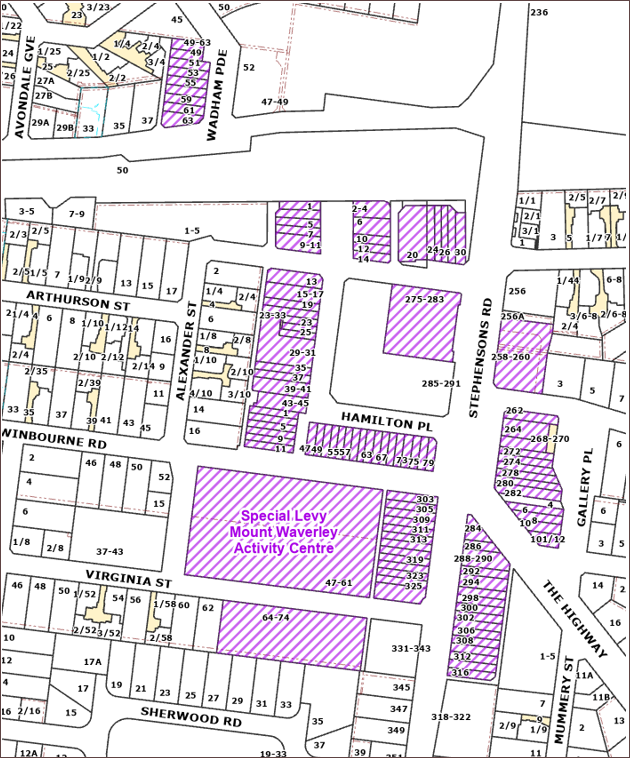

The proposed Mount Waverley Activity Centre Special Charge is to be levied on all rateable land located within the Centre which is primarily used, or adapted or designed to be used, for commercial purposes. The Proposed Scheme area appears below.

A copy of the proposed declaration, including a detailed map of the Proposed Scheme area, is available for inspection at Council offices at 293 Springvale Road, Glen Waverley for at least 28 days after the date of this notice.

It is proposed that the Mount Waverley Activity Centre Special Charge will be assessed and levied as follows:

| Property Address |

Proposed annual charges |

|

1 to 11 Hamilton Walk, Mount Waverley

1 to 79 Hamilton Place, Mount Waverley

2 to 30 Hamilton Place, Mount Waverley

275 to 283 Stephensons Road and 303 to 329 Stephensons Road, Mount Waverley

258-316 Stephensons Road, Mount Waverley

4 to 12 The Highway, Mount Waverley

64 to 74 Virginia Street, Mount Waverley

47 to 63 Wadham Parade, Mount Waverley

|

Ground floor properties

$520

First floor and above properties

$260

|

It is proposed that the special charge will be levied by sending notices to the persons liable to pay it. Payments are made in either four instalments or a lump sum, in accordance with the Council’s general rate collection process.

The special charge, based on $520 for a ground floor property and $260 for a first floor or higher rateable property, will be adjusted on 1 December 2023 and on each anniversary of that date by the September quarter Consumer Price Index (All Groups, Melbourne) (“CPI”) during the 12 months preceding the end of that September quarter.

In the first year, the Proposed Scheme is estimated to raise $72,280. The Proposed Scheme is estimated to raise $361,400 in total over five years.

Council considers that each rateable property included in the Proposed Scheme area that is required to pay the Mount Waverley Activity Centre Special Charge will receive a special benefit because the viability of the Centre as a commercial, retail and professional area will be enhanced through increased economic activity.

Submissions

Any person may make a submission in relation to the Proposed Scheme. A person making a submission is entitled to request in the submission that he or she wishes to appear in person, or to be represented by a person specified in the submission, at a meeting to be heard in support of the submission.

Submissions must be lodged by Thursday 10 November 2022 and will be considered in accordance with section 223 of the Act.

Submissions will be heard by Council at its meeting on Tuesday 15 November 2022.

Any person making a written submission under section 223 of the Act is advised that details of submissions may be included within the official Council Agendas and Minutes which are public documents, and which may be made available on Council's website.

Objections

Any person who will be required to pay the Mount Waverley Activity Centre Special Charge is also entitled to exercise a right of objection under section 163B of the Act. An occupier of a property is entitled to exercise the right of objection if the person submits documentary evidence with their objection which shows that it is a condition of their lease that the occupier is liable to pay the Mount Waverley Activity Centre Special Charge in respect of the property.

Objections must be made in writing and lodged by Thursday 10 November 2022.

The right of objection is in addition to the right to make a submission.

Submissions and/or objections must be in writing and addressed and sent by mail or email to:

Coordinator – Economic Development

City of Monash

293 Springvale Road

GLEN WAVERLEY VIC 3150

Email: ecodev@monash.vic.gov.au

Council will consider whether to declare the Proposed Scheme at a meeting on Tuesday 29 November 2022.

Any person requiring further information concerning the proposed declaration of the special rate and charge should in the first instance contact the Economic Development team on 03 9518 3674 or email ecodev@monash.vic.gov.au

DR ANDI DIAMOND

CHIEF EXECUTIVE OFFICER